Willmott Dixon has announced a 48% rise in half year pre-tax profits compared to last year.

With profit before tax and amortisation at £12m (2015: £8.1m), turnover at £598m and a secured/probably forward order book of £1.15 billion, the firm has also unveiled plans to restructure the company in 2017.

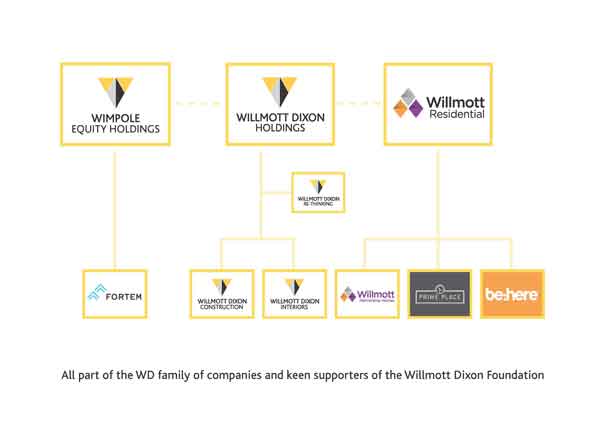

Two subsidiary companies, Willmott Dixon Holdings and Willmott Residential, will branch out' and become sister companies to the business. In addition, Wimpole Equity Holdings will also become a sister firm.

Explaining the move, Group chief executive Rick Willmott said: "This very much recognises each company's specialisms and it gives senior management greater freedom and flexibility to shape their businesses to pursue specific growth agendas for their markets; but with strong cultural, leadership and ownership continuity. The revised structure also supports our wish to give top management in each of our three core businesses a more direct share in their company and in the success they help create.

"Willmott Dixon will remain a billion pound plus company in 2017 and we'll focus on our core strength of contracting, both new build and fit-out, with 85% of budgeted workload identified and secured for 2017."

(LM/CD)

UK

UK Ireland

Ireland Scotland

Scotland London

London